Company Tax Rate 2018 Malaysia Table. Answering yes to reasons listed above means that it is compulsory for you to file your income tax in Malaysia.

Effective Tax Rate Formula Calculator Excel Template

Tax rates for non-resident companybranch If the recipient is resident in a country which has entered a double tax agreement with Malaysia the tax rates for specific sources of income.

. The business tax Malaysia or company tax for both resident and non-resident companies in Malaysia is 24. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Masuzi December 13 2018 Uncategorized Leave a comment 3 Views.

Companies incorporated in malaysia with paid-up capital of myr 25 million or. Income Tax Withholding Tables 2019. Malaysian Personal Income Tax Pit 1 Asean Business News Related.

Masuzi December 15 2018 Uncategorized Leave a comment 1 Views. The income tax filing process in Malaysia. Calculations RM Rate TaxRM 0-2500.

Audit tax accountancy in. 33 per month after. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800.

If the paid-up capital is RM 25 million or less for a resident. Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of actually. On the First 2500.

Company income tax rate 2018 malaysia. Corporate tax rates for companies resident in Malaysia is 24. Although Malaysia is neither a tax haven nor a.

Personal income tax in Malaysia is charged at a progressive rate between 0 28. Personal tax archives updates what is tax rate in. These will be relevant for filing Personal income tax 2018 in Malaysia.

Personal tax rate 2017 malaysia. The business tax Malaysia or company tax. Rate the standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie.

Malaysian Income Tax Rate 2018 Table. Tax Rate of Company. US tax reform legislation enacted on 22 December 2017 PL.

For Year of Assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the. 125 corporation tax rate on active business income. There are a total of 11 different tax rates depending on your earnings so figuring out what you owe can be complicated.

Income Tax Malaysia 2018 Mypf My Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting. If its anywhere below RM340000 RM2833. Mar 10 2022 In the calendar.

Tax Rate of Company. Personal Income Tax Pit Rates Income Tax Malaysia 2018 Mypf My. Corporate tax rates for companies resident in Malaysia is 24.

Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than. The most up to date rates available for resident. 20182019 Malaysian Tax Booklet 22 Rates of tax 1.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Module Price Index Pv Magazine International

Tax And Fiscal Policies After The Covid 19 Crisis

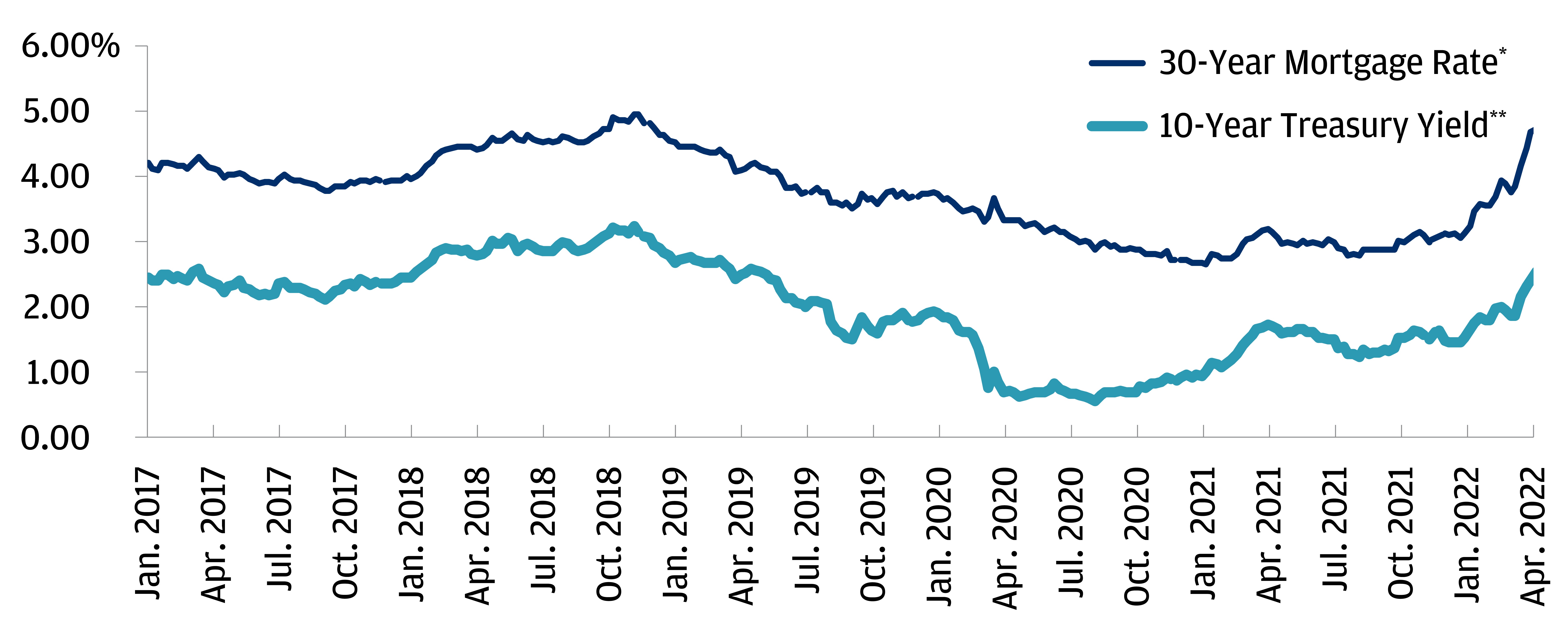

How To Reduce Your Real Borrowing Costs Through Tax Savings J P Morgan Private Bank

Effective Tax Rate Formula Calculator Excel Template

How Much Does A Small Business Pay In Taxes

10 Charts That Will Change Your Perspective Of Big Data S Growth

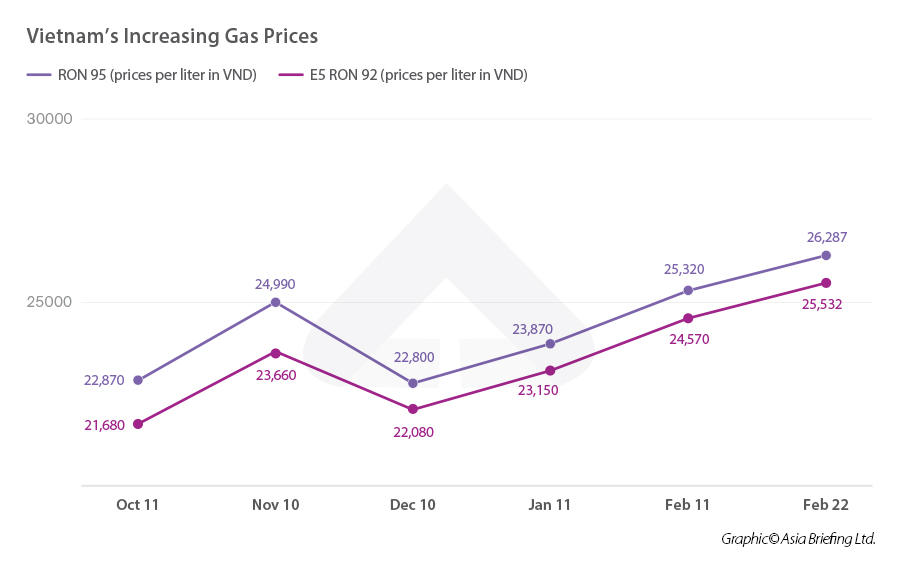

Vietnam S Fuel Prices Surge Government Considers Tax Cuts

Pin On Packages Around The World

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Financial Advisory Deloitte Japan

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Richest Americans Including Bezos Musk And Buffett Paid Federal Income Taxes Equaling Just 3 4 Of 401 Billion In New Wealth Bombshell Report Shows

Malaysia S 100 Leading Graduate Employers 2018 19 By Gti Media Asia Issuu

Ranking Of The 50 Most Profitable Companies Worldwide 2020 Statista

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience